Discover Wyoming Federal Credit Union: Your Trusted Financial Companion

Discover Wyoming Federal Credit Union: Your Trusted Financial Companion

Blog Article

Unlock Exclusive Perks With a Federal Lending Institution

Federal Debt Unions use a host of exclusive advantages that can considerably influence your monetary well-being. From enhanced financial savings and examining accounts to lower rate of interest prices on car loans and customized financial planning services, the advantages are tailored to assist you conserve money and achieve your financial objectives much more efficiently. There's more to these advantages than simply financial benefits; they can likewise give a feeling of protection and area that goes beyond standard financial services. As we discover further, you'll find how these distinct advantages can absolutely make a difference in your financial journey.

Membership Eligibility Requirements

To end up being a member of a federal lending institution, people should satisfy certain eligibility criteria developed by the organization. These requirements differ depending on the specific credit union, however they often consist of aspects such as geographical area, work in a particular sector or firm, membership in a specific company or association, or family members connections to current members. Federal credit score unions are member-owned financial cooperatives, so qualification demands remain in location to make sure that individuals who join share an usual bond or association.

Enhanced Savings and Inspecting Accounts

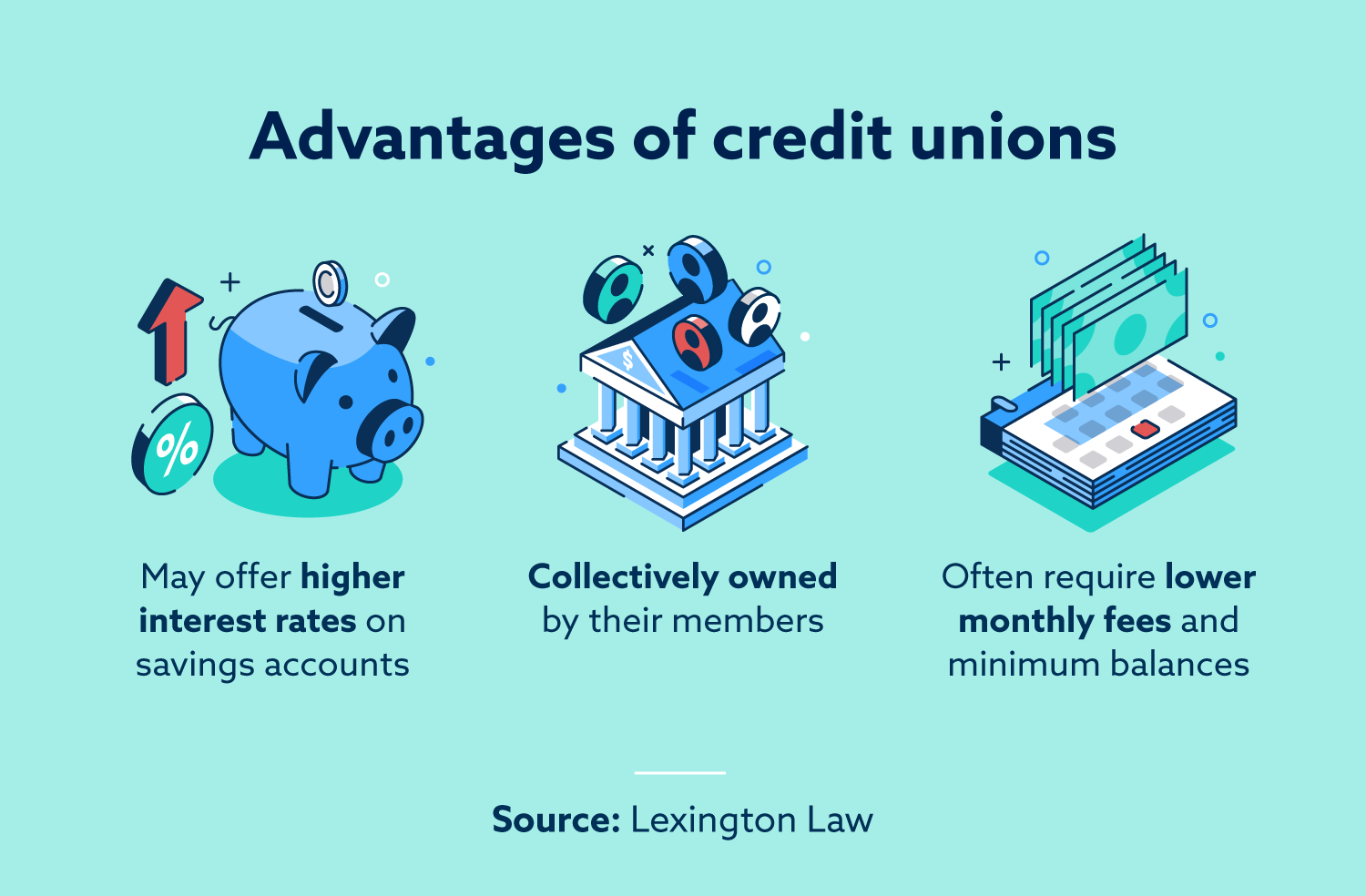

With enhanced financial savings and examining accounts, government cooperative credit union offer members premium financial items developed to enhance their finance approaches. These accounts commonly feature higher rate of interest on cost savings, reduced charges, and extra advantages compared to typical financial institutions. Members can appreciate features such as affordable dividend prices on interest-bearing accounts, which assist their cash expand faster in time. Inspecting accounts might offer benefits like no minimal equilibrium demands, free checks, and atm machine charge repayments. In addition, government cooperative credit union commonly provide online and mobile financial services that make it convenient for members to check their accounts, transfer funds, and pay bills anytime, anywhere. By using these enhanced savings and examining accounts, participants can maximize their savings potential and effectively handle their daily funds. This emphasis on giving premium economic products establishes government cooperative credit union apart and demonstrates their commitment to aiding participants attain their economic objectives.

Reduced Rate Of Interest Rates on Fundings

Federal credit scores unions supply participants with the benefit of lower rate Get the facts of interest rates on financings, enabling them to obtain cash at more inexpensive terms compared to other economic organizations. Whether members need a loan for an auto, home, or individual expenditures, accessing funds through a federal credit union can lead to a lot more favorable repayment terms.

Personalized Financial Preparation Provider

Provided the emphasis on improving participants' economic health with lower rate of interest prices on loans, federal credit unions likewise supply customized monetary planning services to assist people in achieving their long-term monetary objectives. By evaluating earnings, possessions, costs, and responsibilities, government debt union economic planners can aid members create a comprehensive monetary roadmap.

Moreover, the customized economic planning services supplied by federal lending institution usually come with a reduced expense compared to exclusive economic experts, making them much more accessible to a bigger array of individuals. Members can take advantage of specialist assistance and competence without incurring high fees, aligning with the credit rating union ideology of focusing on members' monetary wellness. Generally, these services aim to equip find this participants to make informed economic decisions, construct wealth, and safeguard their monetary futures.

Accessibility to Exclusive Participant Discounts

Participants of federal cooperative credit union delight in special accessibility to a series of participant price cuts on numerous products and services. Credit Unions Cheyenne. These discount rates are an important perk that can assist participants conserve cash on special acquisitions and day-to-day expenditures. Federal lending institution typically companion with sellers, solution providers, and various other services to offer discount rates solely to their participants

Participants can take advantage of discounts on a selection of items, consisting of electronics, apparel, travel packages, and extra. On top other of that, solutions such as car services, resort bookings, and home entertainment tickets may also be available at affordable prices for lending institution participants. These unique discount rates can make a considerable distinction in participants' spending plans, allowing them to appreciate financial savings on both vital products and deluxes.

Conclusion

Finally, joining a Federal Lending institution supplies numerous advantages, including enhanced cost savings and checking accounts, reduced rate of interest prices on fundings, customized financial planning solutions, and access to unique participant discount rates. By coming to be a participant, people can profit from a range of financial benefits and services that can aid them conserve cash, strategy for the future, and strengthen their ties to the neighborhood neighborhood.

Report this page